- HOME

- Market And Trade

- Market And Trade

The Great Transformation of China's Beverage Market

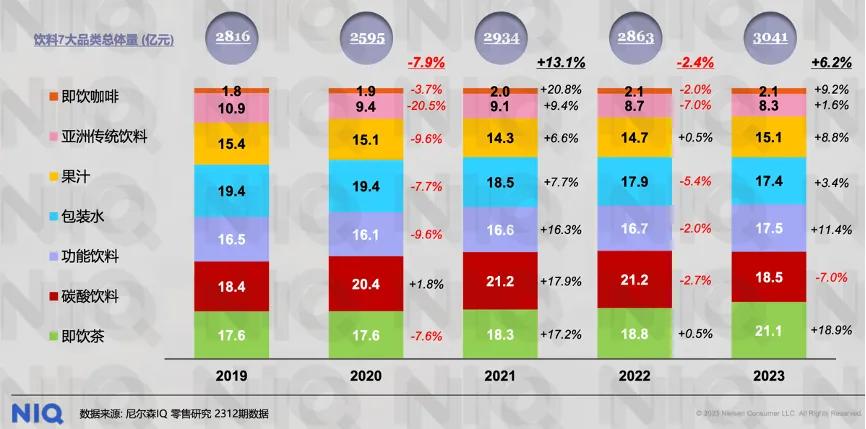

Before 2022, carbonated beverages still ranked first in market share among the seven categories. But in 2023, the market share dropped by 3 percentage points and was surpassed by ready-to-drink tea for the first time.

As the largest cola brand in the Chinese market, Coca-Cola's performance in 2024 was not ideal. Behind the barely maintained sales volume, Coca-Cola offset the decline in sales by raising prices. At the same time, domestic beverages such as Chi Forest, Eastroc Super Drink, Nongfu Spring, and Da Yao have occupied a place in the segmented track.

Ready-to-drink tea, energy drinks and coffee have been the main growth drivers of China's beverage market in recent years.

Nielsen's "2024 China Beverage Market Trends and Outlook" released in 2023 mentioned that the overall growth rate of China's beverage market in 2023 was 6.2%, of which the single categories with growth rates exceeding the average line included ready-to-drink tea, functional drinks, juice and ready-to-drink coffee.

In the first half of 2024, three Coca-Cola beverage companies in Hubei, Jiangxi and Zhengzhou issued notices announcing price adjustments for a variety of products including carbonated beverages, juices and flavored beverages, with an overall increase ranging from 7% to 25%. The gross profit per box disclosed in the financial report increased by 8% compared with last year, which also confirmed the fact that Coca-Cola stabilized its performance by raising prices.

The rise of new products means a reduction in the cola market. A very simple truth is that the domestic carbonated beverage market has not grown significantly or even negatively, but the sales of domestic beverage brands are growing in response, so it is obvious whose share has been taken away.

The beverage brand participants in the Chinese market mainly include Chi Forest, Nongfu Spring, Master Kong, Eastroc Super Drink, etc., and the advantageous products of these companies are mainly electrolyte water, ready-to-drink tea, functional beverages, etc.

The Nielsen report pointed out that functional beverages will become the second largest category in 2023 with an increase of 11.4%, and the first is ready-to-drink tea, with an increase of 18.9%.

Nongfu Spring relied on the efforts of ready-to-drink tea to record positive growth in its annual performance in 2024, which was hit by public opinion. In 2024, Nongfu Spring suffered a storm of public opinion, and its packaged water business revenue of 15.95 billion yuan recorded a sharp decline of 21.3%. The reason why the annual performance was able to achieve a 0.5% increase in the end was all due to the revenue of 16.745 billion yuan from tea beverages, which achieved a 32.3% increase over 2023.

Nongfu Spring's tea beverage products mainly include Oriental Leaf Tea and Tea Pi. In particular, Oriental Leaf Tea has achieved market success with sugar-free tea drinks. In 2011, Nongfu Spring launched its first sugar-free tea, Oriental Leaf Tea. In 2016, netizens voted for the "Top 5 Worst-Tasting beverages in China", and Oriental Leaf Tea ranked among the top. However, by 2019, Oriental Leaf Tea became the brand with the largest market share in the sugar-free tea category.

As ready-to-drink tea, sugar-free has brought new growth points to bottled tea.

Contact Us

Add: 414, Institute of Quality Standard and Testing Technology for Agro-products of Chinese Academy of Agricultural Sciences, No. 12, Zhongguancun South Street, Haidian District, Beijing, China

Email:typ@withworld.cn

Tel:+86 10 53647310