- HOME

- Market And Trade

- Market And Trade

China's Tea Export Volume and Value Rise in First Three Quarters of 2025

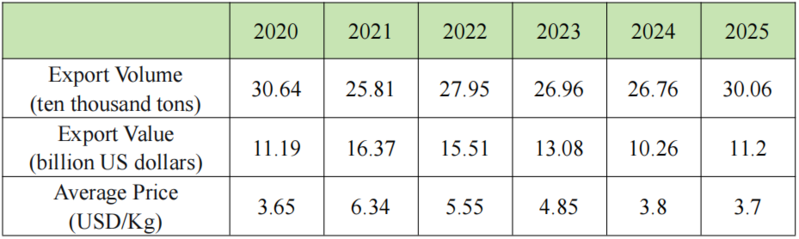

Recently, Chinese customs released tea export data for the first three quarters (Jan-Sept) of 2025. The data shows that China's tea export volume reached 306,000 tons, valued at approximately 1.12 billion dollars, representing year-on-year increases of 14.5% and 9.1% respectively. The average price was 3.7 dollars per kilogram, a decrease of 2.6% compared to the same period last year.

An analysis of China's tea export data from 2020 to the first three quarters of 2025 reveals that the overall export volume has shown a fluctuating recovery trend. The trend in export value has not completely synchronized with the volume; particularly between 2021 and 2024, while export volume recovered or remained stable, the export value continued to decline. The average export price surged to 6.34 dollars per kilogram in 2021 but subsequently experienced continuous adjustments in the following years, falling back to 3.7 dollars per kilogram in 2025, essentially returning to the 2020 level. This trend indicates that China's tea exports are facing challenges amidst changing international market demand and intensified competition. There is an urgent need to consolidate and expand international market share by enhancing product added value and optimizing the export structure.

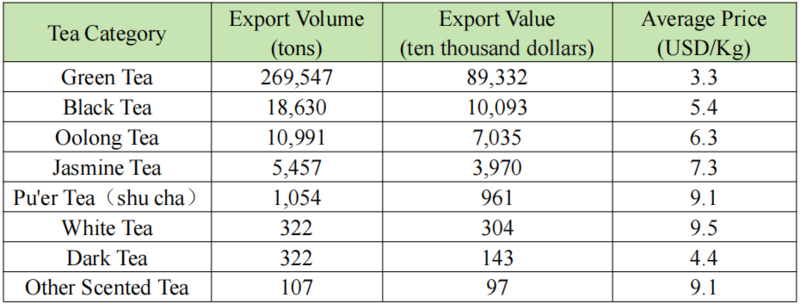

Different tea categories show significant differences in export scale, value, and price. From January to September, green tea, black tea, and oolong tea ranked top three in both export volume and value. Green tea firmly maintains its dominant position. In the first nine months of this year, its export volume reached 269,500 tons, far exceeding other tea types, with an export value of 890 million dollars, representing year-on-year growth of 16.5% and 15.8% respectively.

China is a major green tea producer with a long history of cultivation, extensive production areas, and sufficient output, providing stable supply support for exports. On the other hand, green tea's refreshing and brisk taste profile enjoys relatively high recognition in the international market, especially maintaining stable demand in traditional tea consumption markets and some emerging markets. Simultaneously, green tea's price-performance advantage also helps it secure a large share in exports.

A comparison with data from the same period in 2024 reveals that the export volume, value, and average price of white tea decreased by 9%, 39.4%, and 33.4% year-on-year, respectively. Dark tea export volume and value fell by 14.9% and 42.0% year-on-year, respectively. It is worth noting that from January to September this year, white tea and dark tea had identical export volumes, but the export value and average price of dark tea were both less than half of those for white tea. This indicates, on one hand, that white tea's unique aging value and health attributes are more likely to command a premium in the international market, especially in developed economies with demand for high-end specialty teas. On the other hand, it exposes the predicament dark tea exports are facing, with both volume and price falling. Dark tea exports rely heavily on traditional overseas Chinese markets, which may currently be facing challenges from economic fluctuations and inventory pressures.

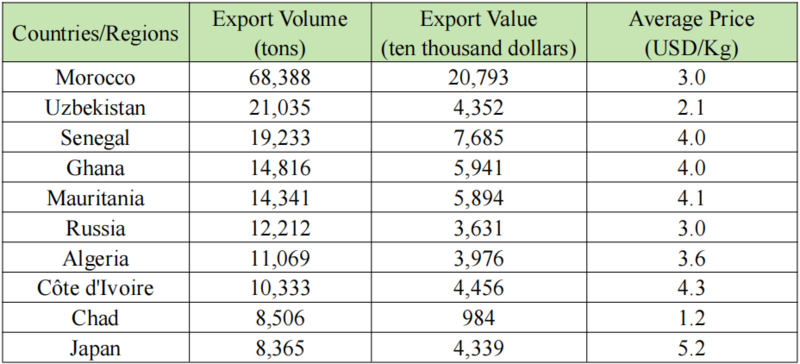

In terms of countries and regions, Morocco remains the largest market for Chinese tea, with an export volume of 68,000 tons and an export value of 200 million dollars, increasing by 22.9% and 25.1% year-on-year respectively. Ranked by export volume from high to low, the next nine markets are Uzbekistan, Senegal, Ghana, Mauritania, Russia, Algeria, Côte d'Ivoire, Chad, and Japan. This shows that North and West African markets constitute the "foundation" and stabilizing ballast for China's tea exports. Russia and Japan, as the few non-African countries on the list, demonstrate that Chinese tea, while meeting mass consumption in developing countries, also possesses the capability to develop different categories and enter high-end markets. Emerging markets represented by Côte d'Ivoire show significant growth potential, becoming new engines for exports.

Contact Us

Add: 414, Institute of Quality Standard and Testing Technology for Agro-products of Chinese Academy of Agricultural Sciences, No. 12, Zhongguancun South Street, Haidian District, Beijing, China

Email:typ@withworld.cn

Tel:+86 10 53647310